The end of the financial year (EOFY) is nearly here!

That means it’s time to get your super exciting paperwork in order.

Yea, yea, we know. Paperwork is not exactly something that makes you jump for joy. But, it is a necessary evil when it comes to your finances.

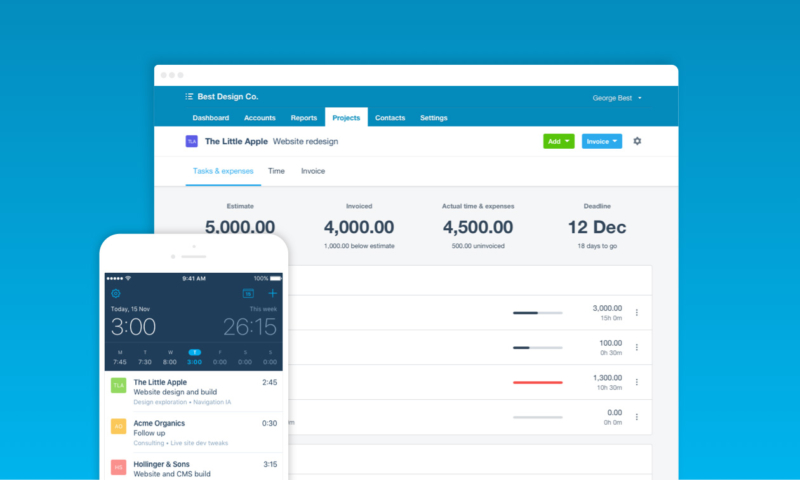

These days, it is less ‘paperwork’ and more online record keeping. So, at least it minimises the risk of paper cuts and back injuries from lugging around filing boxes.

However, there is still quite a lot of jargon which can be hard to get your head around.

So, we’ve put together this handy reference of some of the most common terms you might need to know at this time of year.

General Terms

EOFY - The first cab off the rank is the one in the very title of this article. Get an easy win on the word by using this acronym with your accountant. They’ll be impressed with your knowledge about the ‘End Of Financial Year’.

Fiscal year - Also known as a financial year, this is the 12 month period used for accounting and tax purposes. It can be different to a calendar year. In New Zealand, most businesses run from 1st April to 31st March in line with the tax year.

Balance sheet - This is a report that shows what your business’s finances look like at a given time. Also known as a Statement of Financial Position, it usually includes a summary of your assets, liabilities and equity. Basically, it’s the balance of what would be left if you sold all your assets and paid your debts.

Profit and loss sheet - Commonly termed the P&L, this report shows how the business fared over a given period, usually a month or the year. It includes gross profit, overheads, expenses and losses and your net profit, all divided amongst your revenue and expense codes.

Tax return - This is what you complete, so Inland Revenue can assess your income and calculate how much tax you need to pay. Different types of businesses and sole contractors will need to complete different tax returns. Make sure you are completing the right one for your situation, and if in doubt, ask your accountant.

Finance Terms

Cash flow - This is money coming in to and going out of your business. It is recorded for a particular period in a cash flow statement and can help you see patterns or issues. If you are making more than you are spending, then you are considered to have positive cash flow. If the opposite is true and you are spending more than you are making, you’ll have negative cash flow. Note, that cash flow is different to profit.

Gross profit - This is the money you have made from selling your goods or services after you have paid for the outgoings (eg paid for the stock which you then sold on). But out of this you still need to pay other expenses like taxes or shareholder drawings.

Net profit - Also known as the bottom line, this is the money you have made after all your expenses and taxes are paid as well. Your net profit is how much money you have actually made for the year.

Accruals - These are amounts that have been earned or spent but that you haven’t yet paid. It might be money coming in from a customer bill or money being paid out to a supplier. Accruals can be recorded on your balance sheet as assets or liabilities.

Accounts Payable (AP) - These are amounts for bills you need to pay, for example, to a supplier or an electricity bill.

Accounts Receivable (AR) - These are amounts for invoices owed to you by customers.

Fixed assets - Anything that cannot be easily changed into cash, such as long-term physical investments like buildings and vehicles.

Liquid assets - These are assets that can quickly be converted into cash.

Depreciation - This is the concept of spreading the cost of physical assets like machinery, vehicles or tech equipment over the course of their life.

Tax Types

Goods and Services Tax (GST) - This is a tax added to the price of many goods and services. It is charged at 15%. Depending on how your business is set up, you may need to register for GST. Your accountant can give you advice on this.

Pay-As-You-Earn (PAYE) - This is the tax that your employees pay on their wages. You should be deducting this from their wages before you pay them, and paying it to the IRD.

Provisional Tax - If you had to pay $5000 or more in tax in the previous tax year, then you will need to pay provisional tax for the following year. This spreads your tax payments throughout the year.

Fringe Benefit Tax (FBT) - This is a tax that you pay on any benefits given to employees, including vehicles for private use, low interest or interest-free loans and discounted or free goods or services.

Covid-19 Related Terms You Might Need To Account For

Covid is still here, and it’s still impacting businesses, particularly in the hospitality sector. So your financial year might have featured some of the following, which will need to be accounted for.

Wage subsidies - These payments were made to help businesses cover wages during lockdowns. Whether you are an employer, sole trader, shareholder employee or partner you’ll need to account for this in different ways. It may be considered taxable income.

Resurgence support payments - This scheme helped businesses that had more than a 30% drop in revenue due to Covid. If you used these payments for business expenses, you don’t need to include them in the tax return but you do need to have them in your GST return.

Small business loan - This is a loan, not income, so it is not taxed, but also there are no tax deductions for repayments.

Tax carry back scheme - This scheme allows you to carry losses back to the preceding income year.

Leave support scheme and short term payment - These allowances are paid to businesses to help them pay staff who have needed time off due to Covid or having to isolate. They may be classified as excluded income, and therefore, you won’t need to pay tax on them.

Need A Tax Translator?

If all of these terms (or at least the vast majority) still seem a bit like a foreign language to you, don’t panic. Our team can be your translators and guides through the EOFY process.

We’ll make the numbers fit, explaining everything to you in plain English as we go along.

Book a time to speak with one of our team now.