- All non-residents and New Zealanders buying and selling any property other than their main home must provide a NZ IRD Number.

- All non-resident buyers and sellers must provide their tax identification number from their home country, along with current identification requirements such as a passport.

- Non-residents must have a NZ bank account before they can get a NZ IRD Number.

- “Bright line” test for anyone (non-resident and New Zealander) buying residential property. Under this new test, gains from residential property sold within two years of purchase will be taxed unless it is the seller’s main home, inherited from a deceased estate or sold as part of a relationship property settlement.

- In addition, the Government is investigating introducing a withholding tax for non-residents selling residential property, to be introduced mid-2016 after consultation.

Bright Line Tests consultation paper issued on 29 June, submissions closed on 24 July.

- bright-line test removes any doubt about a seller’s ‘intention’ and makes it clear that all property buyers, including overseas buyers, who buy and sell a residential property within two years will be taxed on their gains

- Once enacted, the bright-line test will apply to residential properties for which an agreement to purchase was entered into on or after 1 October 2015.

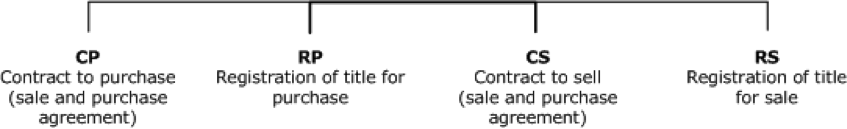

Date of acquisition and disposal

- date of acquisition will be the date that title is registered for the purchase (RP)

- date of disposal should be the date that a person enters into a contract to sell the property

Subdivision of an existing title

- The date of acquisition for subdivided land by an owner is the original date of acquisition of the undivided land by the owner.

- An example is a person who acquires residential land in February 2016, subdivides the land in 2022, and sells the back section in 2023. The sale of the back section will not be subject to the bright-line test. The treatment is appropriate because the sale of the existing title would not be subject to the bright-line test because it would have occurred more than two years after the land was acquired. However, if the back section had been subdivided and sold in 2017, the sale would be caught by the bright-line test.

Sales of the right to sell (including sales “off the plan”)

Bright-line test applies when a person:

- disposes of residential property before taking legal ownership (RP); and

- the disposal was within two years of the seller entering into a sale and purchase agreement (CP).

Definition of “residential land” under bright line test.

- land that has a dwelling on it; or

- land for which there is an arrangement to build a dwelling on it; (may be commercial now but is proposed to be developed into residential properties).

- but does not include land that is used predominantly as business premises or as farmland.

.jpg)