In uncertain times or slowing sales, you need to move quickly to protect your bottom line. Ignoring or delaying a decision to ‘cut’ the fat from your business will significantly impact your business’ performance, cash flow and future survival. Examining and restructuring your costs will ensure your business not only survives but thrives when sales slowdown.

Consider these 3 simple cost saving strategies.

1. Income > expenses

Do you know your business’ breakeven point? Break Even Analysis identifies the minimum sales you require to cover your “necessary” business expenses. It requires you to calculate your total fixed costs (ie. rent, interest etc), gross profit margin and then you ‘sensitise’ your sales to produce a break even result ($0 profit).

Once you have determined your breakeven point, be realistic in assessing your likely sales and recalculate your result as your gross profit margin fluctuates.

2. Reduce your fixed costs

Successful businesses have their cost structure weighted to variable costs (ie. low fixed costs). Activity Based Costings a process that enables you to analyse and change your cost structure. For example, using contractors to provide non-core services to your business or outsourcing the distribution of your products (ie. freight) are examples of variable cost strategies.

3. Identify your business’ strengths and weaknesses

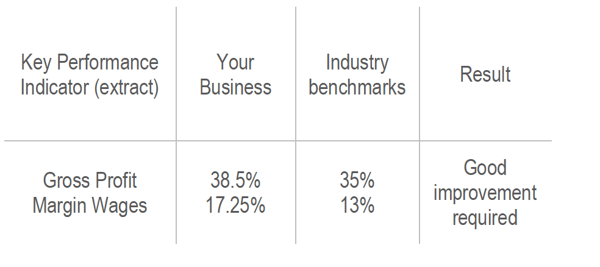

benchmarking is a process that allows you to compare your business performance to ‘like’ businesses. Consider the example below.

Changing your sales mix by focusing on high margin product or service lines and offering incentive rewards to staff are examples of benchmarking strategies to increase gross profit and reduce wages costs as a % of sales. Benchmarking data can be collected from your Industry Association, Accountant or Financial Adviser.

Changing your sales mix by focusing on high margin product or service lines and offering incentive rewards to staff are examples of benchmarking strategies to increase gross profit and reduce wages costs as a % of sales. Benchmarking data can be collected from your Industry Association, Accountant or Financial Adviser.

Independent and Objective Advice

Implementing cost savings measures can be a difficult and emotional process. Your Accountant or Financial Adviser is best positioned to provide you with professional advice. Seek their advice and ask their assistance to implement these strategies.

Disclaimer: this information is of a general nature and should not be viewed as representing financial advice. Users of this information are encouraged to seek further advice if they are unclear as to the meaning of anything contained in this article. Bstar accepts no responsibility for any loss suffered as a result of any party using or relying on this article.