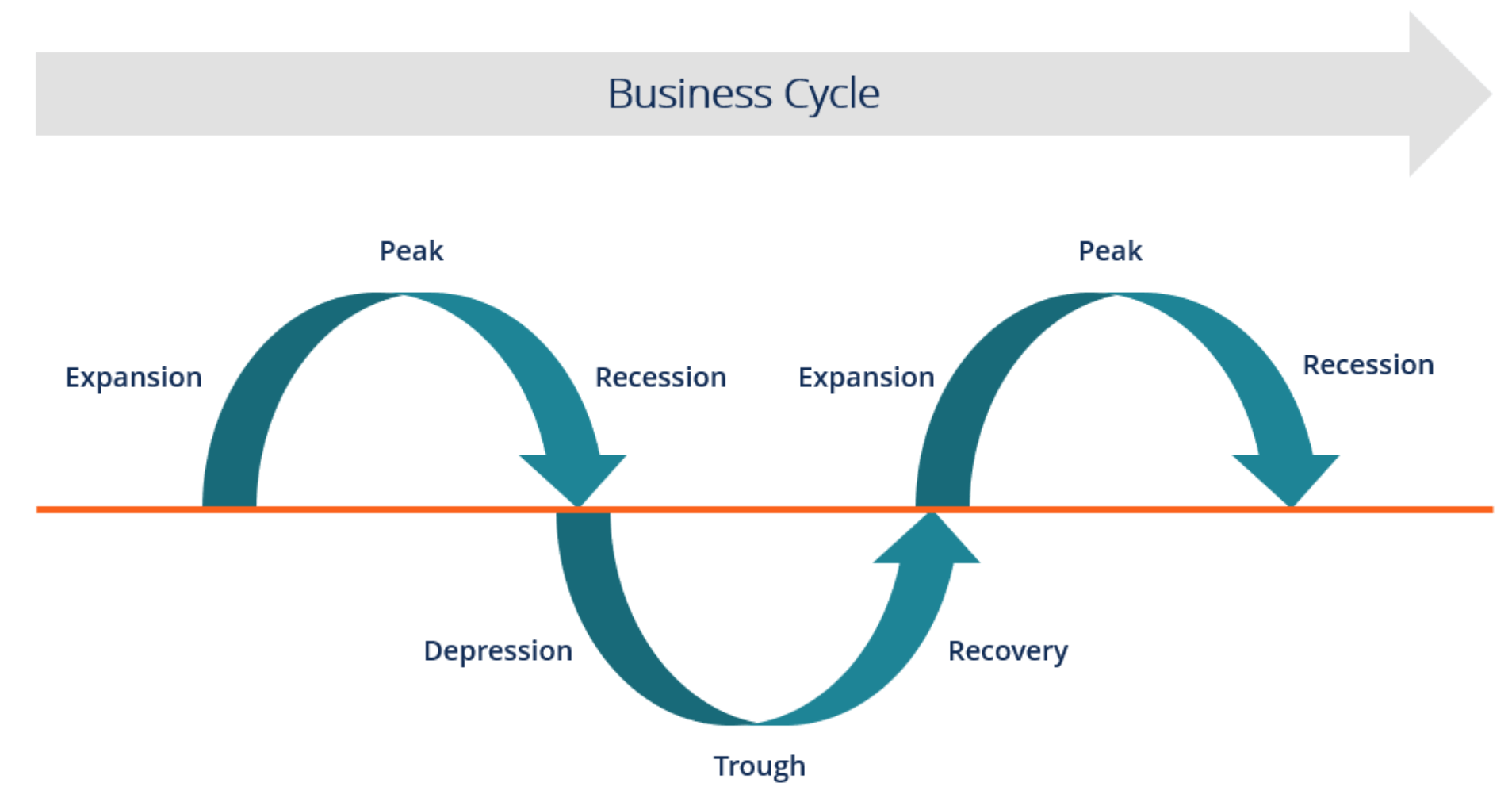

Every business experiences peaks and troughs. Whether they be from expected seasonal fluctuations or unexpected events like a global pandemic.

While you can’t possibly predict everything that will come along and impact your business, you can accept that change is a given.

Sometimes your business will be up, sometimes it’ll be down. But what determines your success in the long run is your ability to adapt to these peaks and troughs and navigate these business cycles year after year.

Here’s our best advice on making the most of those peaks and getting through those troughs in one piece.

Understand Your Unique Business Cycles

Many of the peaks and troughs in your business will be predictable. Things like seasonal demand - perhaps an increase (or decrease, depending on your industry) over the holidays – can generally be forecast, so there’s no excuse if you’re caught short when they roll around.

Knowledge is your biggest asset when it comes to managing your business cycles. The better you can determine your seasonal cycle, the better you’ll be able to prepare your business to meet the demands of those peaks and troughs.

Your financial data is your most valuable tool, so get ready to delve into it as you:

-

Look to the past. Your historical data holds a ton of clues about your business cycles. Use financial reports to get insight into when your peaks and troughs are likely to appear. If you don’t have this data (or don’t know how to access or analyse it), spend some time getting your bookkeeping and accounting in order. Also, get advice from an expert on the best way to generate and review the most vital financial statements for your business.

-

Predict the future. A crystal ball would be nice, but the next best thing is a cash flow forecast. Produce these vital documents regularly to give you an idea of how your finances look in the coming months. By forecasting your potential income and expenses, you can begin identifying weak areas before they sneak up on you. This gives you time to come up with and implement a plan to address any issues.

Manage Your Cash Flow

While we’re on the subject of cash flow, did you know that 18% of businesses experience a cash flow crisis at least once a month?

If this is common for your business, you need to get on top of it quick smart. A lack of cash flow can very quickly snowball, causing significant problems for your business – whether you’re in a peak or trough!

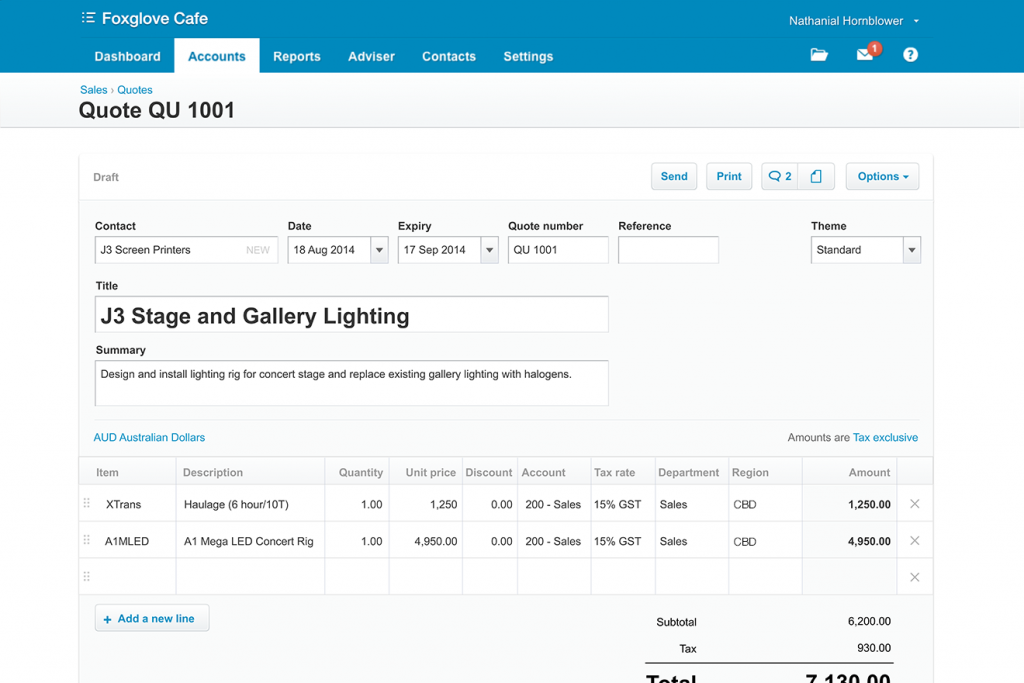

Along with regular cash flow forecasting, make sure you stay on top of the essentials, like streamlined invoicing and encouraging your customers to pay promptly.

Optimise Your Staffing

Your staffing decisions can have an enormous impact on your ability to navigate bumpy business cycles. You must have the capacity to handle times of increased demand but the flexibility to scale back when necessary.

Outsourcing tasks to freelancers is a great way to increase adaptability – you can scale up or down quickly and efficiently according to your needs. Also, explore casual contracts or flexible work hours for your team during high and low seasons.

Use your downtime wisely too. If things are quiet, invest in upskilling your existing employees to help them work more efficiently. Training them in different skill sets also gives you the flexibility of moving them around within the business to fill in where needed.

Have A Financial Back-Up Plan

Life is unpredictable, so we must remember to plan for the worst, even while hoping for the best - and as we’ve seen in the last few years, the worst can be entirely unforeseen!

If you break a leg or become ill, for example, the last thing you want to worry about is trying to borrow money to save your business while you’re out of action.

Start by prioritising an emergency savings fund for your business. Make sure it has enough money in it to cover all your expenses for at least three months, preferably six.

It’s also worth talking to your bank about setting up a line of credit or overdraft that can be accessed in an emergency.

Manage Your Inventory Wisely

Smart inventory management is an essential consideration at any time. Use your business data to try and predict the amount of stock you’ll need at each stage of your business cycles. You don’t want to experience the extremes of too little or too much stock, so managing your inventory is key to keeping out of financial trouble.

Be Strategic

The most successful businesses are those that are strategic and adaptable. If you’re strategic enough, you may be able to alter those business cycles in your favour.

If you experience seasonal peaks and lows specific to your industry, perhaps you can come up with products and services that will be in demand during your low phases, minimising the impact of these fluctuations.

Alternatively, could you expand your business strategically to better meet the demands of those peaks?

Get Expert Advice

No matter what business cycle you’re surfing right now, there’s one thing you can be sure of, and that’s change! The highs don’t last forever, nor do the lows.

The best way to prepare your business is by making sure your financial data is up to date, reviewing it regularly, and strategically putting that information to good use.

If you aren’t sure how to do that OR you simply don’t have the time to dedicate to the task, then have a financial expert do it for you.

The team here at Wise Advice have a wealth of experience in helping businesses manage their business cycles, get in touch with us today.