Keeping track of sales, earnings, expenses, and purchases is fundamental to the overall health and sustainability of your business. Effective bookkeeping produces the data you need to evaluate your current practices, anticipate challenges, and set attainable future goals.

But despite their proven importance, many business owners dread and avoid accounting tasks. In fact, 40% of surveyed entrepreneurs claim that bookkeeping is one the worst parts of running a business!

Wondering if it’s really worth the aggravation?

Here are four reminders of how effective bookkeeping is the cornerstone of small business success.

Keeping track of reimbursable expenses

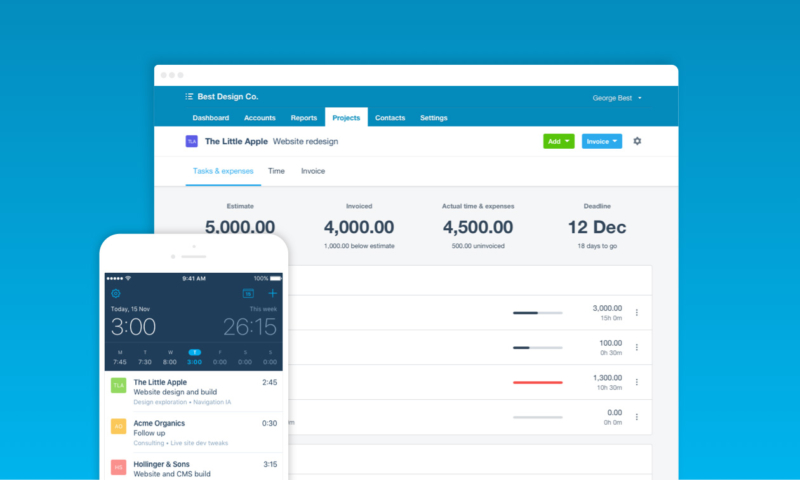

A reliable system for tracking reimbursable expenses ensures you reap all the benefits you’re entitled to when filing your taxes. Expenditures sorted into categories, such as “food”, “travel”, and “office supplies,” can be catalogued quite simply with online bookkeeping software.

Using a dedicated credit card for business expenses, and updating your records on a monthly basis, will put money back in your pocket come tax time.

Click to download our most popular guide - Deductible Business Expenses Cheatsheet

Measuring profitability and planning for the future

In order to grow your business, you must be able to track and compare its finances from one year to the next.

In addition to reconciling the books and bank statements every month, effective bookkeeping generates records you can use to gain a comprehensive overview of your business. This data can help you:

- measure year over year profits;

- identify opportunities to cut costs;

- plan for major expenses (such as new office space, equipment, or staff); and

- develop data-based strategies for expansion.

Preparing for tax season

Few things are more stressful for business owners than scrambling to get poorly maintained financial records ready for tax season. In addition to the panic of last-minute filing, inaccurate or incomplete documentation can lead to serious penalties, fines, and even an audit.

In the United States alone, 40% of small businesses pay an average penalty of $845 per year for late or incorrect filings!

Save money and get peace of mind with sound bookkeeping. You’ll be assured of compliance with regulations, and will receive a reliable estimate of amounts owing long before your tax bill is due.

Final tip: ask for help

Most entrepreneurs are passionate about developing new business ideas – not crunching numbers. Employing a professional bookkeeper, even on a part-time or as-needed basis, can help optimize your accounting and increase overall profitability.

There’s a good reason 71% of small businesses outsource at least one accounting function to help manage tasks like payroll, closing the books each month, and managing accounts receivable.

It’s well worth it. Invest in effective bookkeeping and you’ll build a solid foundation for a resilient, forward-moving small business.